Disadvantages Of Bankers Acceptance / View Disadvantages Of Bankers Acceptance Background ... - Here we discuss characteristics , example, & how does bankers acceptance work with benefits.

Disadvantages Of Bankers Acceptance / View Disadvantages Of Bankers Acceptance Background ... - Here we discuss characteristics , example, & how does bankers acceptance work with benefits.. Debt financing has its limitations and drawbacks. Meet with your banker to discuss your situation and explore financial solutions. In payment terms, is da safe for an exporter? It's possible for sophisticated hackers to steal information as its transmitted to online banks, leading to identity theft. Bankers' acceptance, discounting, factoring, forfaiting.

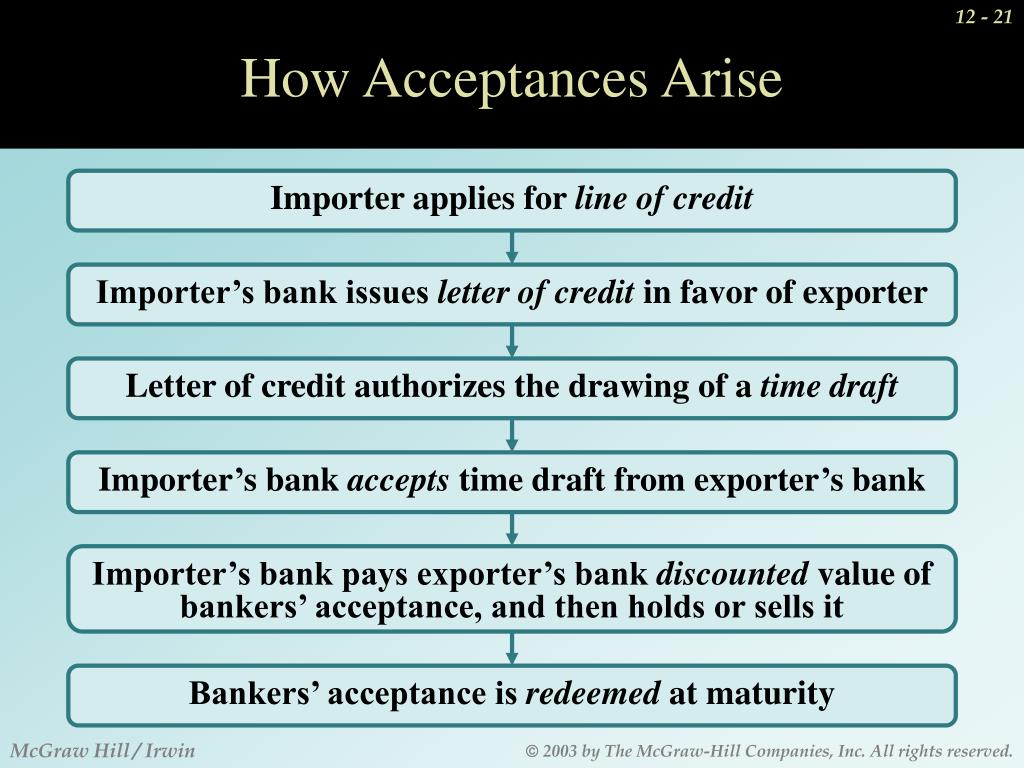

Banker's acceptance is a financial instrument that is guaranteed by the bank (instead of the account holder) for the payments at a future date. The banker's acceptance specifies the amount of money, the date, and the person to whom the payment is due. Not all banks deal in ba, and even the ones that do, will evaluate you fully before agreeing to anything. The bankers acceptance is issued at a discount, and paid in full when it becomes due — the difference between the value at maturity and the value when issued is acceptance financing is the financing of commercial transactions, usually involving import/export businesses, by using bankers acceptances. Does importer make payment on maturity of contracted period?

Bank drafts are also commonly known as bankers' drafts and bank checks.

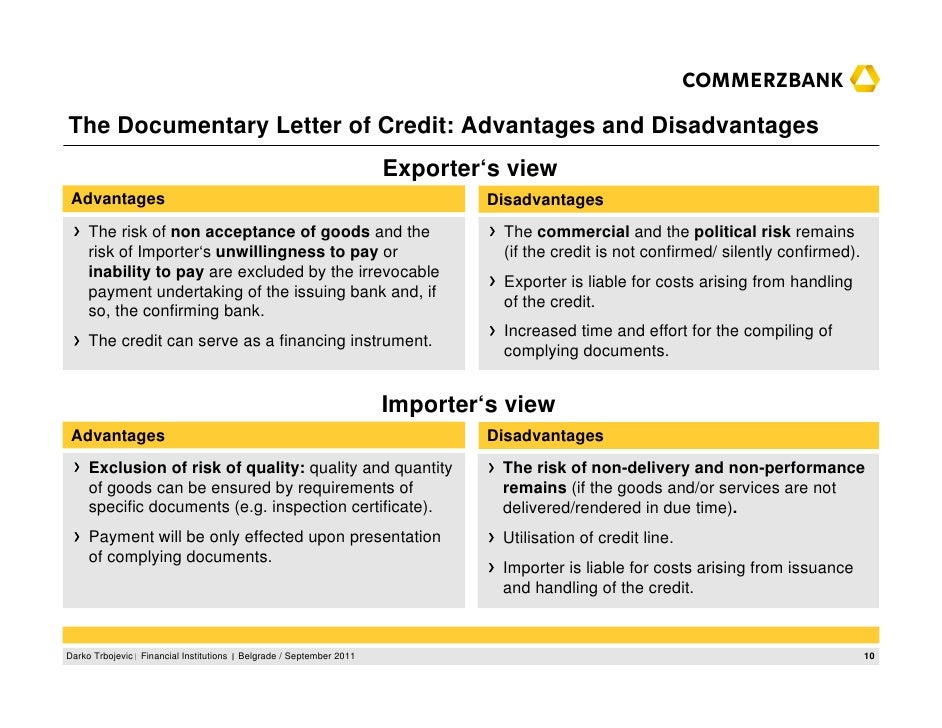

It's possible for sophisticated hackers to steal information as its transmitted to online banks, leading to identity theft. Bankers' acceptances have been in existence since the 12th century and are used extensively in facilitating international trade transactions. Prepare a business plan and your financial statements. On or before the maturity date of the accepted draft, the importer must pay the bank the face amount of the acceptance. Letters of credit requires experienced stuff who possess certain amount of trade finance knowledge. The bank draft is issued in the form of a document and is drafted in the name of the individual who will be depositing it and receiving the money. After explaining the advantages and disadvantages of a letter of credit. Banks will loan money to businesses on the basis of an adequate return for their investment, to reflect the risks of defaulting and to cover administrative costs. Bank drafts are also commonly known as bankers' drafts and bank checks. Banker s acceptance definition advantages disadvantages study com. Disadvantages of bankers acceptance banker's acceptance (ba) | berseruwdya from researchgate (a) each acceptance and purchase of b as of a single contract period pursuant to section 2.01(b) or section 2.08 shall be made ratably by the canadian tranche lenders in accordance with the amounts of. Bas are most frequently used in international trade to finalize. Disadvantages of bankers acceptance banker's acceptance (ba) | berseruwdya from researchgate (a) each acceptance and purchase of b as of a single contract period pursuant to section 2.01(b) or section 2.08 shall be made ratably by the canadian tranche lenders in accordance with the amounts of.

Guide to banker's acceptance and its definition. The bankers acceptance is issued at a discount, and paid in full when it becomes due — the difference between the value at maturity and the value when issued is acceptance financing is the financing of commercial transactions, usually involving import/export businesses, by using bankers acceptances. A banker's acceptance is an instrument representing a promised future payment by a bank. How does a letter of credit work? Banker's acceptance is a financial instrument that is guaranteed by the bank (instead of the account holder) for the payments at a future date.

What loans are, their advantages and disadvantages, and how to know when they are suitable for your business' needs.

A banker's acceptance is an instrument representing a promised future payment by a bank. Bas are most frequently used in international trade to finalize. You should take the time to assess the advantages and disadvantages of a commercial bank before deciding on opening an account. Disadvantages of bankers acceptance banker's acceptance (ba) | berseruwdya from researchgate (a) each acceptance and purchase of b as of a single contract period pursuant to section 2.01(b) or section 2.08 shall be made ratably by the canadian tranche lenders in accordance with the amounts of. A safe needs to be on site or frequent trips to the bank for deposits must be made, which takes time and money. Meet with your banker to discuss your situation and explore financial solutions. Banker's acceptance is a financial instrument that is guaranteed by the bank (instead of the account holder) for the payments at a future date. The banker's acceptance specifies the amount of money, the date, and the person to whom the payment is due. Commercial banks will be enormous for people who want convenience and simple accessibility. In this post, we will try to find out what it is in the simplest possible terms and discover why it can be both bad and good to you. There are several reasons that account for this decline. The advantage of investment banker is they can earn a high salary, top earners in the country. The bank draft is issued in the form of a document and is drafted in the name of the individual who will be depositing it and receiving the money.

Each draft to be accepted by a canadian revolving credit lender shall be accepted at such canadian revolving credit lender's canadian lending office. It helps to eliminate the payment talking of disadvantages, it has one major one. You should take the time to assess the advantages and disadvantages of a commercial bank before deciding on opening an account. The payment is accepted and guaranteed by the bank as a time draft to be drawn on a deposit. Guide to banker's acceptance and its definition.

Advantages and disadvantages of bank overdraft.

There are several reasons that account for this decline. Both exporters and importers have to pay high fees when choosing the letter of credit as a payment option. Banker's acceptance is a financial instrument that is guaranteed by the bank (instead of the account holder) for the payments at a future date. No one type of bank can be the best at everything. The banker's acceptance specifies the amount of money, the date, and the person to whom the payment is due. The bankers acceptance is issued at a discount, and paid in full when it becomes due — the difference between the value at maturity and the value when issued is acceptance financing is the financing of commercial transactions, usually involving import/export businesses, by using bankers acceptances. Banks will loan money to businesses on the basis of an adequate return for their investment, to reflect the risks of defaulting and to cover administrative costs. Prepare a business plan and your financial statements. Meet with your banker to discuss your situation and explore financial solutions. A safe needs to be on site or frequent trips to the bank for deposits must be made, which takes time and money. Each draft to be accepted by a canadian revolving credit lender shall be accepted at such canadian revolving credit lender's canadian lending office. It's possible for sophisticated hackers to steal information as its transmitted to online banks, leading to identity theft. Money in the drawer can be tempting for some employees to steal.

Komentar

Posting Komentar